Awareness of climate change

The Paris Agreement, adopted in 2015, clearly states a shared global goal of keeping the rise in average temperatures from pre-industrial levels well below 2℃. The Sixth Assessment Report by the IPCC (Working Group I), published in 2021, unequivocally concluded for the first time that human activities are the dominant cause of global warming. It warned that unless greenhouse gas emissions are significantly reduced over the coming decades, global temperatures are likely to exceed 1.5℃ and 2℃ above pre-industrial levels within the 21st century. The report also highlighted changes in the climate system, including the increasing intensity and frequency of natural disasters. Furthermore, the Synthesis Report released in 2023 reaffirmed these scientific findings and emphasized the urgent need for deep and immediate reductions in greenhouse gas emissions.

In November 2017, the Asset Management Company established the “ESG (Environment, Society, Governance) Policy” and is promoting ESG responses in order to maintain and improve the corporate value and the asset value of the properties under management over the medium to long term, and to contribute to all stakeholders. We recognize that addressing climate change is one of the most important issues.

Endorsement of the TCFD recommendations and participation in the TCFD Consortium and JCI

In FY2021, the Asset Management Company endorsed the TCFD recommendations.

Identifying, assessing, and managing the risks and opportunities that climate change poses to MFLP-REIT’s asset management business in line with the TCFD Final Recommendations and enhancing the resilience of the business, are essential to ensure the MFLP-REIT’s sustainable and stable earnings over the long term. We will consider further enhancement of information disclosure in the future.

By endorsing the TCFD recommendations, the Asset Management Company joined the TCFD Consortium and the Japan Climate Initiative (JCI). Many Japanese companies and organizations that have endorsed the TCFD recommendations participate in this Consortium, where their approaches to promoting climate-related disclosure are discussed and shared. JCI, a domestic network in Japan aiming for decarbonization, disseminates messages toward achieving net zero and compiles and provides information related to climate change. In 2024, together with 236 supporting organizations, it submitted a joint statement to the Japanese government calling for an ambitious 2035 target aligned with the 1.5℃ goal. In addition to exchanging information with other participants through its activities in the TCFD Consortium and JCI, the Asset Management Company proactively disseminates information on its approach to climate-related disclosure.

In addition, as a member of the Association for Real Estate Securitization, the Asset Management Company regularly collects information on outstanding efforts by other member companies to reduce environmental burdens and build a sustainable society, which will be useful for further raising environmental awareness and expanding such efforts.

- * TCFD is an abbreviation for Task Force on Climate-related Financial Disclosures. This organization was established by the Financial Stability Board at the request of the G20, and provides a framework for climate-related disclosure.

Governance

In accordance with the Climate Change Resilience Policy, the Asset Management Company has designated the President & CEO as the responsible director for climate-related issues and the Chief Investment Officer as the responsible executive for climate-related issues.

In accordance with the Climate Change Resilience Policy, the Asset Management Company has designated the President & CEO as the responsible director for climate-related issues and the Chief Investment Officer as the responsible executive for climate-related issues.

The responsible executive regularly reports to the Sustainability Promotion Committee, which includes the responsible director, on matters related to the identification and evaluation of the impact arising from climate change, the management of risks and opportunities, progress of initiatives, and the setting of indicators and targets.

The Sustainability Promotion Committee deliberates and reviews each agenda item, and decisions are made by the responsible director.

Climate-related issues are promoted within a supervisory framework centered on the President & CEO, who is the responsible director.

Strategy

In order to incorporate the uncertainties arising from the progression of climate change into the business strategy of the Asset Management Company, we have identified risks and opportunities, conducted scenario analyses based on a 1.5℃ scenario and a 4℃ scenario, and assessed the financial impact of climate-related risks and opportunities.

Scope of scenario analysis

The scope of the analysis is the asset management business of MFLP-REIT. In response to the evolving landscape of climate change, MFLP-REIT has conducted scenario analyses based on both the 1.5℃ and 4℃ pathways. Through these analyses, we have evaluated the potential financial impacts of climate-related risks and opportunities.

Main scenarios referenced

| Publishing agency/organization | 1.5℃ scenario | 4℃ scenario | |

|---|---|---|---|

| Transition risk | International Energy Agency (IEA) |

IEA World Energy Outlook2024 NZE2050 |

IEA World Energy Outlook2024 SPS |

| Physical risk | Intergovernmental Panel on Climate Change (IPCC) |

Sixth IPCC Assessment Report IPCC RCP2.6 |

Sixth IPCC Assessment Report IPCC RCP8.5 |

| Risks | Minor | Moderate | Major | ||||||

| Opportuniteis | Minor | Moderate | Major | ||||||

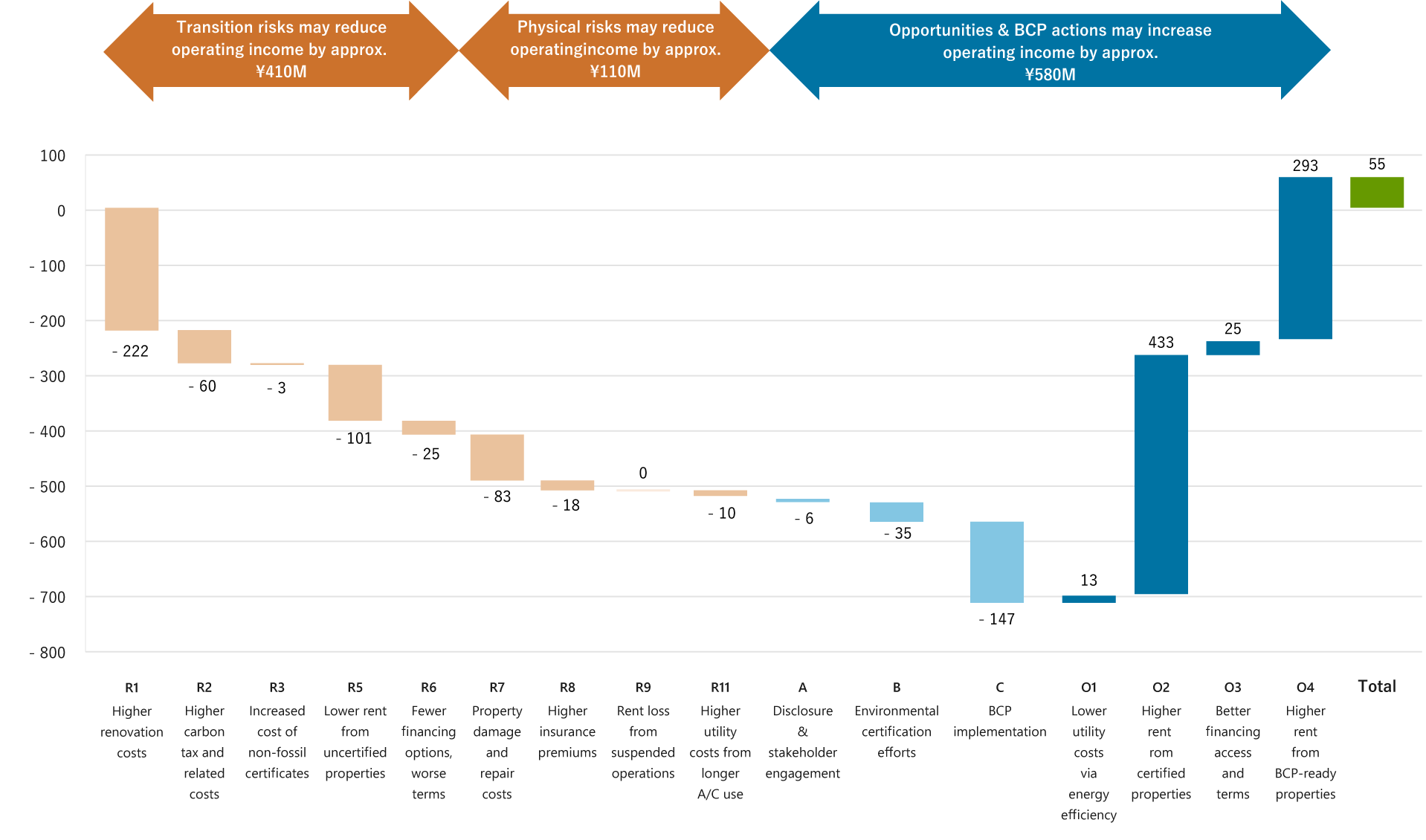

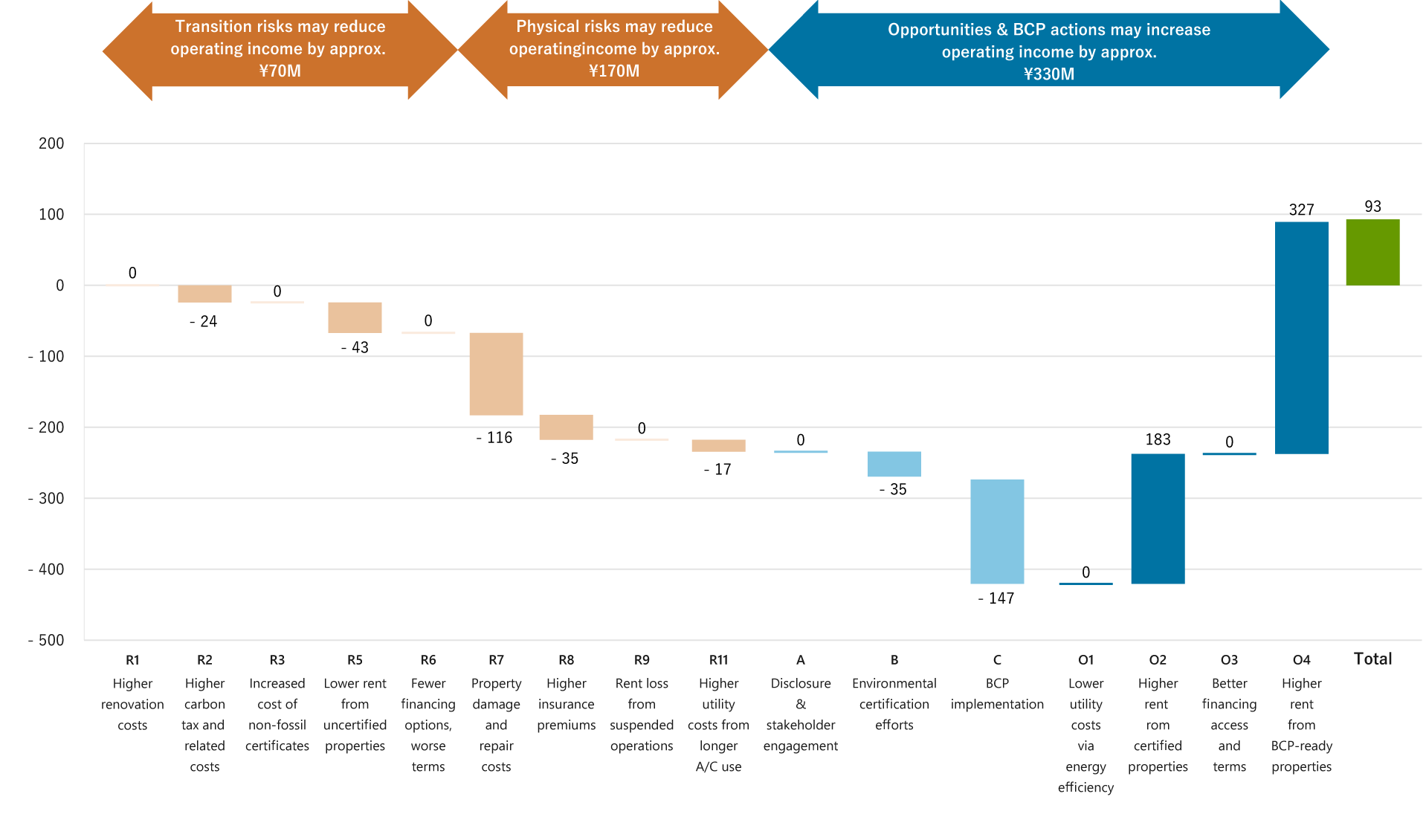

| Related item for property management | Expected financial impact | Category | Degree of financial impact (Millions of JPY) |

Response by the Asset Management Company | |||||

|---|---|---|---|---|---|---|---|---|---|

| 1.5℃ scenario | 4℃ scenario | ||||||||

| medium term |

Long term |

medium term |

Long term |

||||||

| Transition risks/opportunities | Policies and laws |

|

R1

|

Risk | -222 | - | 0 | - |

|

|

R2

|

-60 | -107 | -24 | -38 | ||||

|

R3

|

-3 | - | 0 | - | ||||

| Technology | Evolution of renewable energy and energy-saving technologies, diffusion of new technologies (Conversion of portfolio to ZEB) |

R4

|

Risk | - | - | - | - | ||

|

O1

|

Opportunity | 13 | - | 0 | - | ||||

| Market/reputation | Changes in tenant behavior |

R5

|

Risk | -101 | -505 | -43 | -213 |

|

|

|

O2

|

Opportunity | 433 | 2,166 | 183 | 914 | ||||

| Change in status of financing |

R6

|

Risk | -25 | -45 | 0 | 0 |

|

||

|

O3

|

Opportunity | 25 | 45 | 0 | 0 | ||||

| Physical risks/opportunities | Acute |

|

R7

|

Risk | -83 | -281 | -116 | -578 |

|

|

R8

|

-18 | - | -35 | - | |||||

|

R9

|

Risk | 0 | - | 0 | - | ||||

| Chronic |

|

R10

|

Risk | - | - | - | - | ||

|

O4

|

Opportunity | 293 | 337 | 327 | 442 | |||

|

R11

|

Risk | -10 | -14 | -17 | -29 |

|

||

- (Note)This estimate is an analysis of part of MFLP-REIT’s business and does not assess the overall impact. In addition, the qualitative assessment shows the annual amount of impact estimated in reference to the scenarios presented by major institutions, etc. based on MFLP-REIT’s portfolio, operational performance, etc., and does not guarantee the accuracy of the figures. The assumed countermeasures are assumptions used in the estimation and their execution has not been planned or decided.

Based on the results of scenario analysis, the Asset Management Company will establish an internal structure, and examine countermeasures, and incorporate such measures into business strategies, while formulating, implementing, and monitoring them repeatedly and continuously, aiming to enhance corporate value and heighten business resilience. Specific initiatives are presented on Environmental Performance Results and Initiatives.

1.5℃ scenario

Even if transition and physical risks related to climate change materialize, it is possible to offset the decline in operating income by leveraging opportunities.

4℃ scenario

Although physical risks from climate change are significant, the decline in operating income can be offset by leveraging opportunities.

Risk management

In order to mitigate climate-related risks and take advantage of opportunities, the Asset Management Company identifies, evaluates, and manages climate-related risks and opportunities based on the following framework.

Process for identifying and evaluating climate-related risks and opportunities

Once a year, the responsible executive invites those who are essential to a climate-related working group, and identifies and evaluates climate-related risks for the Asset Management Company. Climate-related risks in this analysis are based on the following framework.

(1) Transition risk: impact on the business of the low-carbon/decarbonization transition of society and the economy

- (a) Policy, law and regulation risk: risk of strengthened regulations caused by policy-driven promotion of decarbonization

- (b) Technology risk: risk arising from the development of new technology, and its adoption by the mainstream, related to low-carbon/decarbonization

- (c) Market risk: risks associated with markets, such as volatility in energy prices and fluctuations in demand for services

- (d) Reputation risk: risk of negative changes in reputation among stakeholders such as customers, the general public, employees, and investors

(2) Physical risk: impact on the business arising from the progression of climate change, resulting in variations from previous weather patterns and climatic phenomena

- (e) Acute physical risk: risks originating in events such as typhoons and flooding

- (f) Chronic physical risk: risks originating in long-term shifts in weather patterns, such as high or low temperatures sustained over long periods

In addition, in cases where themes and elements that could provide business opportunities to the Asset Management Company and MFLP-REIT are identified during the process of uncovering risks, these are identified as climate-related opportunities in a separate category from risks, and their feasibility is investigated.

The responsible executive provides regular reports to the Sustainability Promotion Committee on the progress and outcomes of work to uncover risks and opportunities performed by the working group.

Process for managing climate-related risks and opportunities

For important climate-related risk and opportunity factors that the Asset Management Company has determined should be addressed as a priority based on the above process, a management process is set out as follows, with the aim of mitigating risks and taking advantage of opportunities.

- For high-priority climate-related risks and opportunities that have been deliberated by the Sustainability Promotion Committee and that are important in the context of business and financial plans, the responsible director designates a team in charge of addressing the issue, and instructs them to draft appropriate measures.

- The measures drafted by the team in charge of addressing the issue will be deliberated by the Sustainability Promotion Committee as necessary, and the details will be finalized in accordance with the appropriate rules governing administrative authority.

- The responsible director gives instructions for climate-related risks that are important in the context of business and financial plans to be taken into account by the existing company-wide risk management program with the aim of integrating risk identification, evaluation and management processes.

Indicators and targets

The Asset Management Company works to establish environmental KPIs, and to set and monitor indicators and targets, with the objective of mitigating climate-related risks and taking advantage of climate-related opportunities. The state of progress for each initiative is summarized at least once a year by the responsible executive, who presents a report to the Sustainability Promotion Committee.

The environmental KPIs that are currently established by the Asset Management Company, together with historical data, are shown on Environmental KPIs, Environmental Performance Results and Initiatives, and Initiatives to Obtain Green Building Certification.

The Asset Management Company will continue to consider and disclose any new environmental KPIs that seemappropriate to set.