Growth Strategy

Mitsui Fudosan's business statement for the Logistics Facilities Business

"Connecting Values Together with Customers and Creating New Value Together with Customers"

As a partner in developing solutions for our tenants, we forge connections among a wide variety of people, goods and ideas, taking on the challenge of creating value beyond conventional boundaries. We contribute to making modern life and society more fulfilling for all.

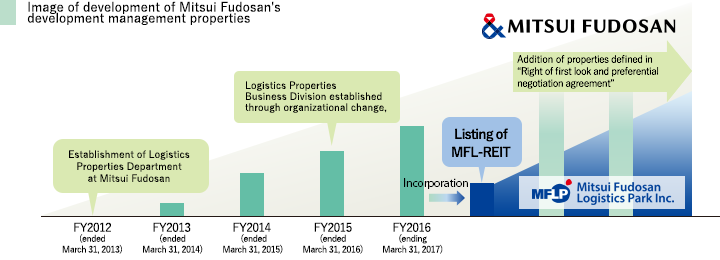

External growth based on the growth potential and extensive pipeline of Mitsui Fudosan's logistics facilities business

MFLP-REIT aims for continuous growth by focusing on MFLP facilities, utilizing the right of first look and preferential negotiation based on "Right of first look and preferential negotiation agreement" that was concluded with Mitsui Fudosan, which boasts high growth in the logistics facilities business.

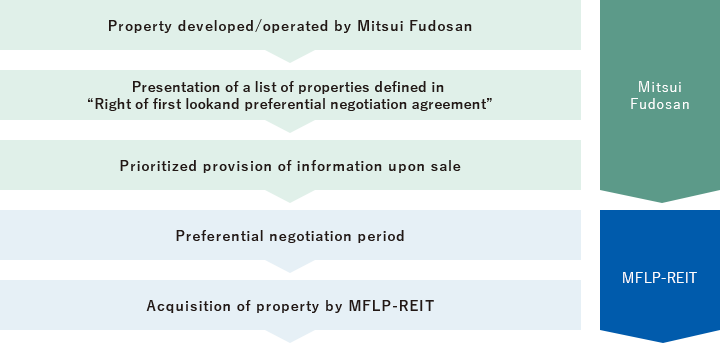

Right of first look and preferential negotiation agreement and external growth of MFLP-REIT

As part of its strategic partnership with Mitsui Fudosan, MFLP-REIT has concluded "Right of first look and preferential negotiation agreement" with Mitsui Fudosan. When Mitsui Fudosan sells properties defined in "Right of first look and preferential negotiation agreement" for which MFLP-REIT notifies its intention to acquire, MFLP-REIT is offered priority in receiving information, in principle, and has the right of first look and preferential negotiation with Mitsui Fudosan for a certain period of time.

Major properties developed or operated by Mitsui Fudosan

Properties defined in "Right of First Look and Preferential Negotiation right Agreement"

7 properties 900 thousand m²(*2)

As of December 18, 2024

| Fiscal year of completion (*3) |

Property developed/ operated |

Location |

Total floor area (*4, 5) |

Acquisition by MFLP-REIT (*6) |

Property defined in “Right of first look and preferential negotiation agreement” (*7) |

|---|---|---|---|---|---|

| FY2013 | MFLP Yokohama Daikoku | Yokohama, Kanagawa | 100,530 m² | ● (50%) | − |

| GLP/MFLP Ichikawa Shiohama | Ichikawa, Chiba | 105,019 m² | ● (50%) | − | |

| MFIP Inzai | Inzai, Chiba | 40,478 m² | ● | − | |

| MFLP Yashio | Yashio, Saitama | 40,728 m² | ● | − | |

| FY2014 | MFLP Kuki | Kuki, Saitama | 73,153 m² | ● | − |

| MFLP Sakai | Sakai, Osaka | 125,127 m² | ● | − | |

| MFLP Funabashi Nishiura | Funabashi, Chiba | 30,947 m² | ● | − | |

| MFLP Atsugi | Aikou, Kanagawa | 40,942 m² | ● | − | |

| FY2015 | MFLP Hino | Hino, Tokyo | 205,200㎡ | ● (25%) | ● (75%) |

| MFLP Kashiwa | Kashiwa, Chiba | 31,242 m² | ● | − | |

| FY2016 | MFLP Funabashi Ⅰ | Funabashi, Chiba | 197,746㎡ | − | − |

| MFLP Fukuoka Ⅰ | Kasuya, Fukuoka | 32,199㎡ | ● | − | |

| MFLP Hiratsuka | Hiratsuka, Kanagawa | 33,061㎡ | ● | − | |

| MFLP Komaki | Komaki, Aichi | 40,597㎡ | ● | − | |

| FY2017 | MFLP Inazawa | Inazawa, Aichi | 72,883㎡ | ● | − |

| MFLP Ibaraki | Ibaraki, Osaka | 230,435㎡ | ● | − | |

| MFLP Tsukuba | Tsukubamirai, Ibaraki | 62,484㎡ | ● | − | |

| FY2018 | MFLP Atsugi Ⅱ | Isehara, Kanagawa | 48,976㎡ | ● | − |

| MFLP Prologis Park Kawagoe | Kawagoe, Saitama | 117,337㎡ | ● (50%) | − | |

| FY2019 | MFIP Haneda | Ota, Tokyo | 80,334㎡ | − | − |

| MFLP Hiroshima Ⅰ | Hiroshima, Hiroshima | 68,427㎡ | ● | − | |

| MFLP Funabashi Ⅱ | Funabashi, Chiba | 227,003㎡ | − | ● | |

| MFLP Kawaguchi Ⅰ | Kawaguchi, Saitama | 49,838㎡ | ● | − | |

| MFLP Hiratsuka Ⅱ | Hiratsuka, Kanagawa | 48,141㎡ | ● | − | |

| MFLP Yokohama-Kohoku | Yokohama, Kanagawa | 45,512㎡ | − | − | |

| MFLP Kawasaki Ⅰ | Kawasaki, Kanagawa | 49,801㎡ | − | − | |

| FY2020 | MFIP InzaiⅡ | Inzai, Chiba | 27,268㎡ | ● | − |

| MFLP Tachikawa Tachihi | Tachikawa, Tokyo | 55,094㎡ | − | − | |

| MFLP Osaka Ⅰ | Osaka, Osaka | 43,919㎡ | ● | − | |

| MFLP Yachiyo Katsutadai | Yachiyo, Chiba | 74,624㎡ | ● | − | |

| MFLP Tosu | Tosu, Saga | 35,248㎡ | − | − | |

| FY2021 | MFLP Tokorozawa | Iruma, Saitama | 21,721㎡ | ● | − |

| MFLP Funabashi Ⅲ | Funabashi, Chiba | 270,321㎡ | − | ● | |

| MFLP Osaka Katano | Katano, Osaka | 68,528㎡ | ● | − | |

| MFLP Ichikawa Shiohama Ⅱ | Ichikawa, Chiba | 166,099㎡ | − | ● (60%) | |

| FY2022 | MFLP Tomei Ayase | Ayase, Kanagawa | 56,764㎡ | ● | − |

| Tokyo Rail Gate East(*8) | Shinagawa, Tokyo | 165,272㎡ | − | − | |

| MFLP EbinaⅠ | Ebina, Kanagawa | 121,909㎡ | − | − | |

| SG Realty MFLP Fukuoka Kasuya | Kasuya, Fukuoka | 35,626㎡ | ● (50%) | − | |

| MFLP ShinkibaⅠ | Koto, Tokyo | 9,584㎡ | ● | − | |

| MFLP Yatomi Kisosaki | Kuwana, Mie | 86,319㎡ | − | − | |

| MFLP Hiratsuka Ⅲ | Hiratsuka, Kanagawa | 29,474㎡ | ● | − | |

| FY2023 | MFLP ShinkibaⅡ | Koto, Tokyo | 27,078㎡ | − | − |

| MFLP Zama | Zama, Kanagawa | 133,932㎡ | − | ● (41.5%) | |

| MFLP•OGUD Osaka Torishima | Osaka, Osaka | 59,350㎡ | − | ● (50%) | |

| MFLP Ebina Minami | Ebina, Kanagawa | 37,470㎡ | − | − | |

| FY2024 | MFLP Sendai NatoriⅠ | Natori, Miyagi | 45,072㎡ | − | − |

| MFLP Nagoya-Iwakura | Iwakura, Aichi | 59,860㎡ | − | − | |

| MFLP•LOGIFRONT Tokyo-Itabashi | Itabashi, Tokyo | 256,157㎡ | − | − | |

| MFLP Tsukubamirai | Tsukubamirai, Ibaraki | 97,378㎡ | − | − | |

| MFLP Yokohama-Shinkoyasu | Yokohama, Kanagawa | Approx. 136,641㎡ | − | ● (51%) | |

| FY2025 | MFLP Aamagasaki Ⅰ | Amagasaki, Hyogo | 35,935㎡ | − | − |

| MFLP Ichinomiya | Ichinomiya, Aichi | Approx. 66,043㎡ | − | − | |

| MFLP Iruma Ⅰ | Iruma, Saitama | Approx. 90,416㎡ | − | − | |

| MFLP Sendai Natori Ⅱ (tentative name) | Natori, Miyagi | Approx. 32,248㎡ | − | − | |

| FY2026 | MFLP Iruma Ⅱ | Iruma, Saitama | Approx. 65,158㎡ | − | − |

| MFIP Ebina | Ebina, Kanagawa | Approx. 40,040㎡ | − | − | |

| MFLP Misato | Misato, Saitama | Approx. 38,826㎡ | − | − | |

| MFLP Sugito (tentative name) | Kitakatsushika, Saitama | Approx. 11,877㎡ | − | − | |

| MFLP Funabashiminamikaijin | Funabashi, Chiba | Approx. 20,570㎡ | − | − | |

| FY2027 | MFLP Kyoto-Yawata Ⅰ | Yawata, Kyoto | Approx. 81,338㎡ | − | − |

| Kashima, Yodogawa-ku Logistics Facility Project (tentative name) | Osaka, Osaka | Approx. 206,578㎡ | − | − | |

| FY2028 | MFLP Kyoto-Yawata Ⅱ | Yawata, Kyoto | Approx. 166,798㎡ | − | − |

| TBD | another data center (3 property) | - | - | − | − |

| TBD | overseas property (10 properties) | - | - | − | − |

Flow regarding provision of right of first look information

| (Note 1) | Scale of cumulative investment is based on materials released by Mitsui Fudosan in November 2024. |

|---|---|

| (Note 2) | Indicates the number of properties and total floor area, including properties defined in "Right of first look and preferential negotiation right agreement". |

| (Note 3) | Construction of MFLP Yokohama Daikoku was completed in fiscal 2009 and commenced operation in the indicated year. MFLP Tsukuba (existing building) was completed in fiscal 2010. |

| (Note 4) | For completed properties; based on the register or inspection certificate For uncompleted properties (defined in "Right of first look and preferential negotiation right agreement"); based on the building confirmation certificate For uncompleted properties (other properties); based on the materials published by Mitsui Fudosan |

| (Note 5) | The area for uncompleted properties is the planned area at the time of acquisition of the building confirmation certificate or at the time of publication by Mitsui Fudosan, and is subject to change. |

| (Note 6) | The ratio in brackets indicates the share of (quasi-)co-ownership for the acquired asset. |

| (Note 7) | Includes properties subject to the right of first refusal. The ratio in brackets indicates the share of co-ownership or (quasi-) co-ownership of properties covered by the "Right of first look and preferential negotiation right agreement". |

| (Note 8) | Mitsui Fudosan was entrusted with the development, drafting of the development plan, and acquisition of tenants for Tokyo Rail Gate EAST. After completion of the project, Mitsui Fudosan will offer master lease services, etc. Mitsui Fudosan has no plans to acquire the property. |

- Related link

- Investing in locations suitable for logistics facilities by focusing on MFLP facilities

Property acquisition utilizing the comprehensive strength of Mitsui Fudosan,

a comprehensive real estate company

Investing in mixed use properties (MFIP, etc.)

Acquiring logistics facilities developed by third parties

In addition to acquiring facilities developed by Mitsui Fudosan, MFLP-REIT plans to aggressively acquire logistics facilities developed by third parties other than Mitsui Fudosan. In doing so, it will use the Mitsui Fudosan Group's network as well as the Asset Management Company's channels and will make acquisitions only after fully examining the capacity of the target property to satisfy individual investment standards as well as its impact on the portfolio.

Investing in overseas real estate

MFLP-REIT makes it possible to acquire overseas real estate pursuant to the Articles of Incorporation to meet mid- to long-term global needs.

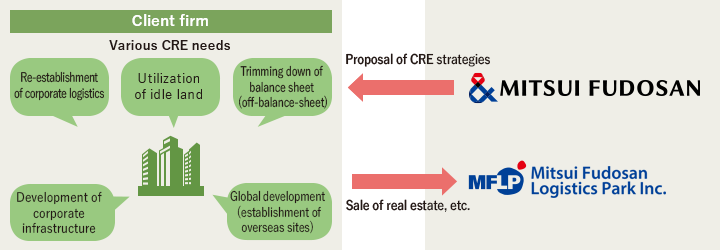

Acquiring properties through proposal of corporate real estate (CRE) strategies by Mitsui Fudosan

By making use of the Platform (business foundation) and broad client network it has developed as a comprehensive real estate company, Mitsui Fudosan stimulates the potential needs of client firms in the area of real estate by proposing corporate real estate (CRE) strategies and offering real estate consultancy. It also offers advisory services on CRE strategy, such as providing solutions for real estate development and sales that meet the needs of its client firms. By seeking close cooperation with Mitsui Fudosan, MFLP-REIT believes that through the proposal of CRE strategies it can achieve external growth as well as the further diversification and stabilization of its portfolio.

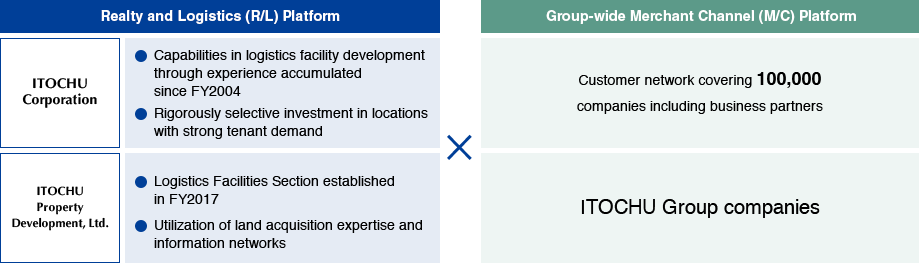

External growth by leveraging the ITOCHU Group’s customer network and its expertise

MFLP-REIT will take advantage of the priority information agreements with ITOCHU Corporation and ITOCHU Property Development, to access the ITOCHU Group’s customer network and its expertise in land purchase, development, and leasing in the field of logistics real estate. In this way, we aim to secure property acquisition opportunities and further diversify and solidify our portfolio.

Stable Sourcing System

Building up pipeline through sponsor support

As it works to expand its asset size, MFLP-REIT has the benefit of pipeline support (provision of priority information) from ITOCHU Corporation and ITOCHU Property Development and extensive external growth support through the ITOCHU Group network.

| Completion date (planned) |

Property under ownership / development | Location | Total floor area (planned) |

Properties subject to priority information provision |

|---|---|---|---|---|

| February 2023 | i Missions Park Kasugai | Kasugai City, Aichi Prefecture | 15,402㎡ | ● |

| June 2023 | i Missions Park Kuwana | Kuwana City, Mie Prefecture | 93,627㎡ | ● |

| September 2023 | i Missions Park Yoshikawa Minami | Takahisa, Yoshikawa City, Saitama Prefecture | 17,918㎡ | ●(50%) |

| December 2025 | i Missions Park Tanotsu (provisional name) | Fukuoka City, Fukuoka Prefecture | Undecided | − |

| September 2026 | i Missions Park Neyagawa (provisional name) | Neyagawa City, Osaka Prefecture | Undecided | − |

Examples

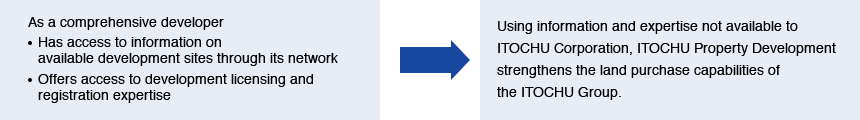

(1) Strengths in land purchase and development of ITOCHU Property Development

ITOCHU Property Development engages in land purchase and development in the field of logistics real estate, drawing on its sourcing routes as a comprehensive developer and the strengths acquired in its extensive track record of development in a wide range of property types.

(2) Access to available development sites through customer networks

ITOCHU Corporation has built a good relationship with Nippon Steel & Sumikin Engineering Co., Ltd. (NSENGI) by placing with it orders for the construction of logistics facilities. On the strength of this relationship, ITOCHU Corporation has been able to acquire unused land assets belonging to NSENGI and its parent company, Nippon Steel & Sumitomo Metal Corporation (NSSMC), for development as logistics facilities.

(3) Response to Group company development needs

Having successfully developed two dedicated logistics centers for its Group company Nippon Access, Inc., the ITOCHU Group has worked together with Nippon Access, which is the centers' tenant, and Fujita Corporation, which is the joint developer and also responsible for design and construction, to plan and manage the official certification process and related procedures in compliance with the Act on Advancement of Integration and Streamlining of Distribution Business.

Scale of Mitsui Fudosan's cumulative investments in logistics facilities business

76 properties ¥1,200 billion(*1)